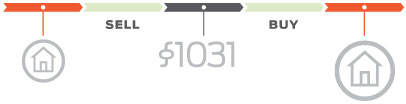

A §1031 Exchange is a powerful wealth building tool and provides investors with a way to adjust or align investment portfolios without paying taxes on every change

The most obvious and most common reason for individuals to do a §1031 Exchange is for the tax benefits. In most states, a §1031 Exchange allows an individual to defer the federal capital gains tax, which is typically 15%, as well as the state capital gains tax, which varies from state to state but ranges from 1-9%. On real estate transactions where the seller has a lot of equity and is going to reinvest that money in another property, the tax deferral can mean a substantial amount that can be leveraged for reinvestment.

There are a myriad additional benefits of doing a §1031 Exchange besides the obvious benefit of tax deferral resulting in increased cash flow. Investors can:

Sell a smaller property, such as a duplex, and use the equity to purchase a larger property, such as an eight-unit garden apartment building.

Sell one type of property, such as a 400-unit apartment building, and purchase a variety of other kinds of property, such as a shopping center, warehouses and a parking garage.

Sell a property that is underperforming, such as 100 acres of vacant land, to purchase an income-generating property like a fully-leased off ice building.

Sell one property, such as an estate home, and purchase several townhomes to use as rental property.

Sell one property, such as a foreclosed home that was renovated, and purchase another foreclosed home that needs renovation.

Sell multiple properties, such as five condominiums, and purchase a 20-unit garden-style apartment building.

Sell a property and reinvest only part of the boot from the sale, and pay capital gains taxes only on any boot that is not reinvested.

Sell a property that requires constant management, such as a hotel or restaurant, and purchase a property that requires no management such as a Tenant-in-Common shopping center.

Sell a property that has a lot of equity but is generating little depreciation, such as an estate home that has tripled in value, and purchase a much more expensive property which will have a much higher rate of depreciation.

Leave property to heirs without paying any capital gains taxes.

They can do this without being penalized by having to pay taxes, either capital gains or recapture*. Those taxes are deferred until the investor sells the property without doing a §1031 Exchange or dies. A §1031 Exchange is a powerful wealth building tool and provides investors with a way to adjust or align investment portfolios with their needs, choices and circumstances, without paying taxes on every change. For example: